Alpha Mail #60

DeltaXBT, Jim's Trading Plan, and Magus on VWAP

INTERVIEW: DELTAXBT

DeltaXBT is a crypto trader and investor that has been active in the markets from the age of 15. He talks risk, patience and Twitter gurus.

“Don’t let your lack of patience ruin you.

The hardest trade is no trade.”

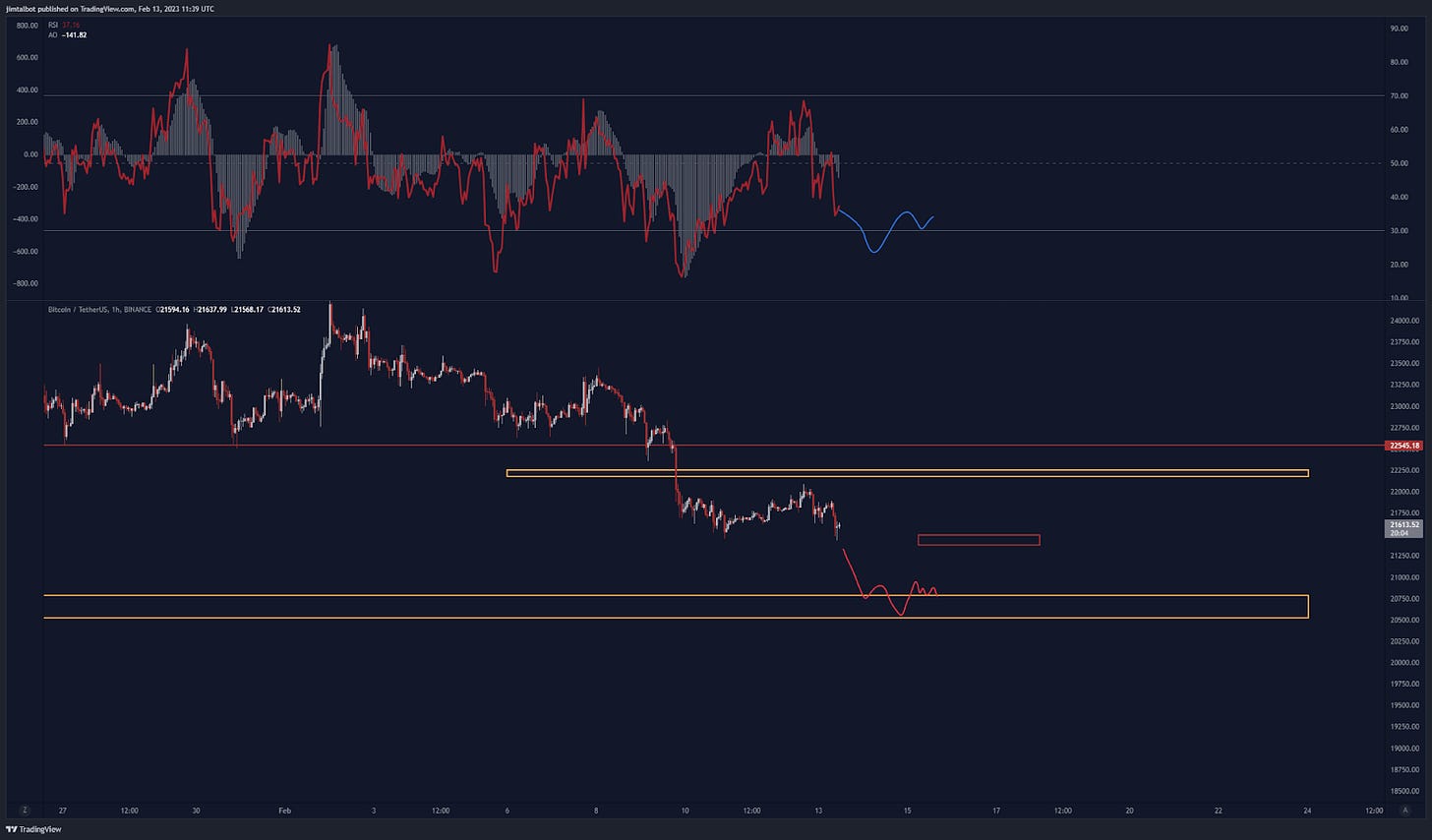

JIM TALBOT: POTENTIAL TRADE PLAN

Keeping it simple this week, Initially, I wanted to take a short in the upper box around $22,200, which unfortunately got front-run. If it gets back up there over the next few hours, I think the EV on the short idea is reduced based on the thought process that it already rejected that region. Price should have no real reason to revisit this level before heading lower.

Now my attention turns to a possible ‘long the bounce’ scenario from my box around $20,500.

Due to ongoing negative news and CPI release, I won’t be looking to fade too aggressively. Instead, I will look for potential 30-minute or one-hour divergences into that level.

TP1 would be the underside of this current consolidation around $21,500, with extended targets back towards the $22,200 level if momentum is sustained.

Overall for the week ahead, I'm keeping my invalidations fairly tight with an emphasis on catching quick moves to minimise my time exposure in light of an upcoming volatility event.

-Jim

MAGUS: VOLUME WEIGHTED AVERAGE PRICE

This is a guest article based on a recent Twitter thread from TraderMagus, introducing the basics of VWAP.

TraderMagus runs The Paragon Group educational community and was the featured interview in Alpha Mail 29.

Thanks to Magus for allowing us to reproduce this information in Alpha Mail.

VWAP?

Think of Volume Weighted Average Price similar to how you would a moving average; only volume is an added component.

TYPES OF VWAP

There are three types of VWAP:

Time - Daily, Weekly, Monthly, Quarterly, Yearly

Anchored - Choose the starting swing point

Rolling - Without resetting, calculates the previous X period of time

VWAP USES

Regardless of timeframe, VWAP is highly effective in bias formation.

For a higher timeframe, VWAP’S strength is in momentum and trend following. For a Lower timeframe, VWAP is effective for identifying both momentum and reversion.

Higher TF

Bias

Momentum; Trend following

Lower TF

Bias

Momentum and Reversion

VWAP FOR BIAS

1. Price and VWAP Structure

2. VWAP Slope

3. Over/Under

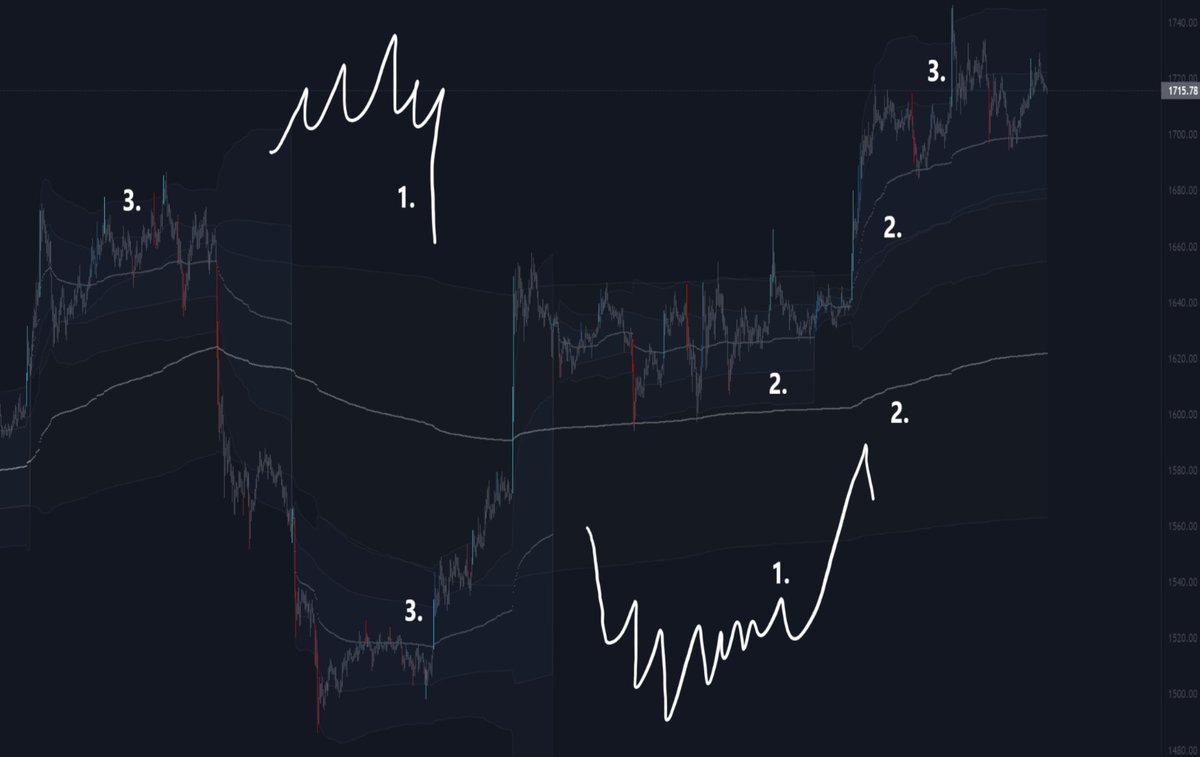

VWAP FOR REVERSION

Logic: Enter into low volume and exit into higher volume

Flat slope

Fade outside deviations, exit at mean

Looser hard stops

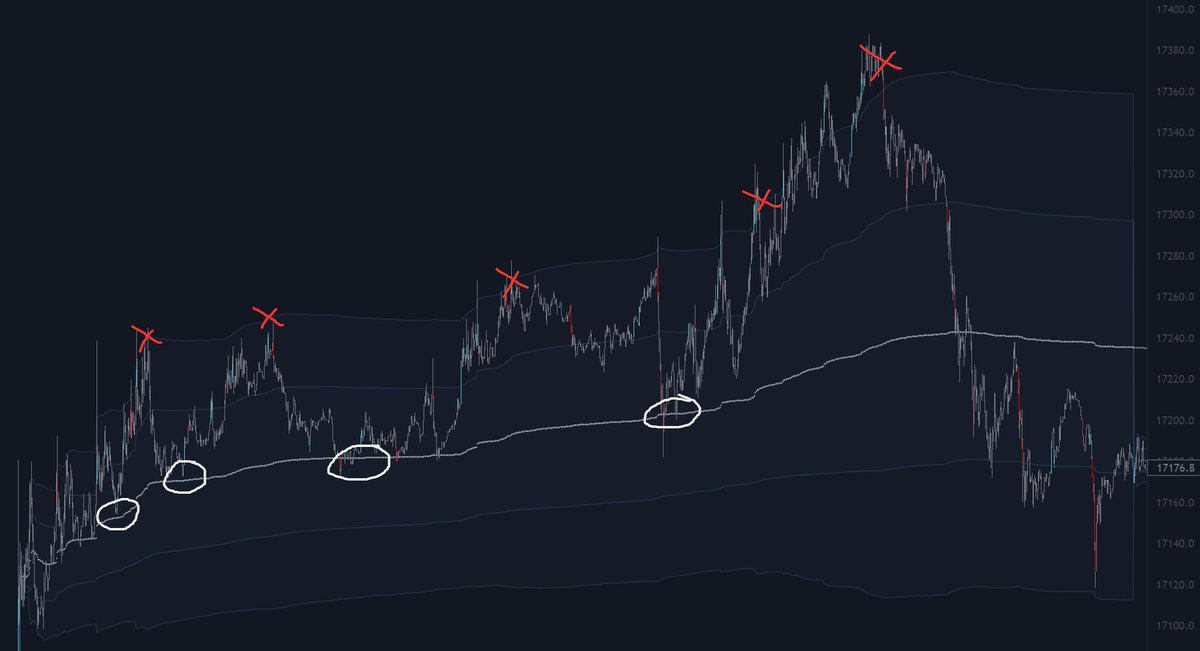

VWAP FOR MOMENTUM

Logic: Enter into higher volume during momentum

Sloped

Enter mean and exit deviation

Tighter hard stops