ALPHA MAIL #52

TheCryptoCactus, Fading BTC/ETH and the recent spike in NFT volume.

INTERVIEW: THECRYPTOCACTUS

TheCryptoCactus talks about his childhood dreams of being a millionaire, how trying to be a scalper was harming his mindset and his wallet, and why everyone has become a CPI trader.

JIM TALBOT: ONLY FOOLS RUSH IN

Whilst the market looks weak and still lacking demand, we seem very exhausted of sellers since the FTX fallout. However, I can see the argument for a move up here.

Bitfinex participants are starting to make some moves and instigate some probes into supply. As shown below, they have been willing to buy into supply, taking the available liquidity.

One thing I have previously noticed about Bitfinex is that they pounce when they spot an opportunity and tend to prey on signs of weakness.

Bitfinex tends to prey on signs of weakness.

Whilst stuck in this range, it's very much 50/50. However, I would be willing to back a move outside this value area as it has been consolidating now for 12 days.

I'm leaning towards it breaking to the upside, but until it does, I'm staying on the fence. If it breaks up, I think it can reach the mid-18k region and possibly further; if it breaks down, it could cycle back down to the lows and possibly break down further.

Initially, I wanted to fade a move into the $17,500 region, but after ranging for such a period, the expected value of that trade diminishes.

Intuition tells me a move up would reignite a bit of activity from participants that have been severely lacking in recent weeks. Whilst a move down is still possible, I think trapping some belief in an upwards move is starting to seem more likely to generate liquidity to be able to sell into again.

trapping some belief in an upwards move is starting to seem more likely to generate liquidity to be able to sell into again.

It's the same story on ETH, it will go whichever way BTC goes. Here are my mid-term levels for ETH.

Based on the week ahead, it seems pretty obvious that a lot will be determined by the CPI number. Whichever way it goes, I will more likely follow the break as opposed to my usual desire to fade it.

-Jim

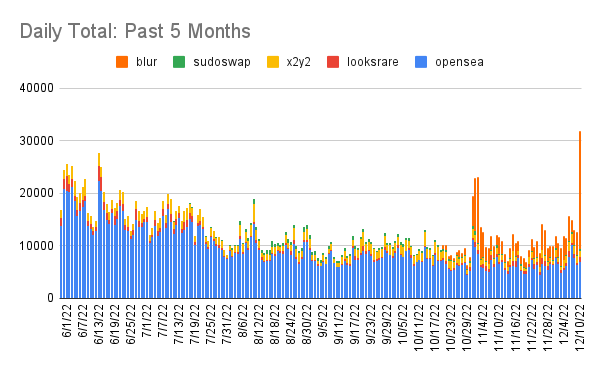

CBS: NFT VOLUME SPIKE

This weekend saw one of the biggest volume spikes witnessed in NFTs for a while. This is interesting for a couple of reasons.

Firstly, we’re acting in the same way that we did during the bull market. When the ETH price was sideways, NFT volume tended to pick up. We’re seeing a similar situation now, given the overall landscape we’re faced with on ETH (and everything else.)

Secondly, the vast majority of the volume came through Blur.

Of course, there will be issues with wash trading that are pumping those numbers up but a huge amount of volume was present across blue chip collections during this window which lead to the average ETH spend also increasing 3x from 0.2 -> 0.6.

This can also be expected during this period, as traders are looking to push volume through Blur ahead of the upcoming airdrop. I’d expect this trend to continue until the airdrop completion period, in January 2023.

So, we’ve seen some hope kick back in. If we are locked in a broadly sideways market for ETH, then potentially, this swing in NFT volume and prices will hang around longer as people look to other areas for value.

As we know, there’s a long way to go, but the blue-chip collections continue to lead the way for activity and the “safest” store of NFT value.

PFPs remain the hot trend and where most of the money is focused.

It’s always been a bad bet to move against those collections, and we’re seeing increasing evidence to support that with their performance during the worst bear market conditions we’ve seen.

A big thank you to Punk9059 for the charts.

-CBS