ALPHA MAIL #49

Lisa N Edwards, adapting to market conditions, and the state of NFTs.

INTERVIEW: LISA EDWARDS

Lisa shares lessons from 25+ years of trading, including mental focus, being a tortoise and a 1600% gain on Elrond.

JIM TALBOT: ADAPT. OVERCOME.

I think we just entered that phase of the market where liquidity and volatility are so scarce, actionable setups become few and far between.

My best advice is to become adaptable. Be nimble and don't marry a position.

The market is far less forgiving in these conditions. If you get a bad entry it often stays a bad entry for much longer. Be swift, don't be afraid to cut entries quickly and look for new entries. This period is about survival and tight risk management.

Preserve your capital, be content with smaller wins and even smaller losses.

If you take a trade targeting a $1000 move for example. Try reducing your expectations and also think “how could I split this up into multiple trades?”

Doing so increases your probability of locking in profits and tightens your risk. I can tell you from experience during peak bear market PA that round-tripping the limited setups available is not a good feeling. You can always get back in.

A good exercise that works for me is having a fixed profit target either per day or per week.

It helps me stay disciplined and really helps improve my ability to trade efficiently. So that when easier times come, I'm sharp.

-Jim

CBS: STATE OF THE NFT MARKET

In the wake of the most impactful and negative scenarios ever unfolding in crypto, you may be asking “but how are those jpegs doing?”

The NFT market has largely withstood the brunt of the FTX blow, but it’s relatively hard to declare that as a positive.

Volume is still trending down, collections are still bleeding, most projects are now zombie projects.

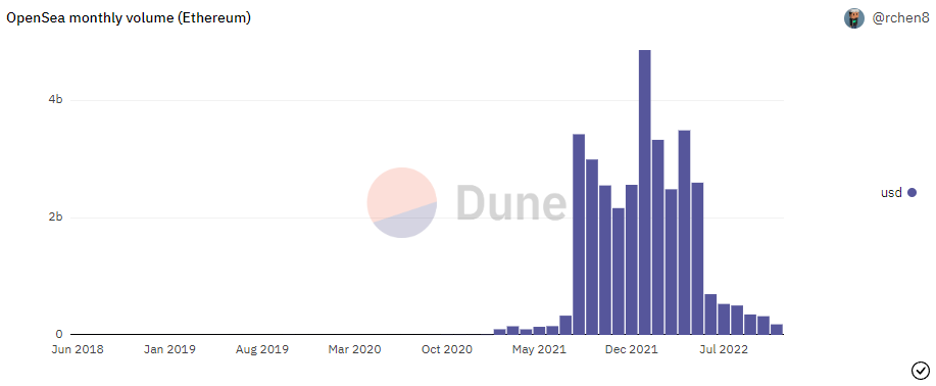

Monthly volume on Opensea has been slowly turning down since June and the trend is in full continuation mode.

Perhaps more concerningly, daily active users on Opensea has been trending down for all of 2022.

The impact of what we are currently going through in the wake of the SBF disaster will continue to impact the NFT markets as participants leave the crypto space overall and we’ll struggle to entice a new wave of NFT buyers to replace them.

But where there’s fear there’s opportunity, right?

Well, yes, and no. As mentioned in one of my early posts, bluechip collections are doing very well still, a lot are holding their value and the quality projects are rising to the top.

Picking the right projects and having broad time horizons are very important.

The other benefit is the price of ETH. Given that ETH is down considerably from where we were during the NFT boom it represents the opportunity for those looking to get interested in blue chips to take the leap. It also represents a great opportunity to start looking around the more bespoke and even greater time horizon market in 1/1 pieces on places like SuperRare or Foundation.

Now, of course, that last thought process will also be rooted in your expectations for the price of ETH.

If you assume ETH will trade much lower then potentially you’ll still be looking to sit out this part of the journey.

I have my own thoughts on where I think ETH will trade and how this affects my spending habits. In these low-volume, low-interest regions, my eye is certainly drawn towards quality pieces that will have a long-term home in my portfolio.

Until we see a change in the NFT user figures, I’ll continue to assume we’re in for a very boring and tedious journey.

-CBS