Alpha Mail - #042 - Glimmerycoin, BTC Price Targets and NFT Outlook

One of my favourite parts of this week's interview with @glimmerycoin is hearing his thoughts on new arrivals at the prop firm he traded at. The ones that went above and beyond to show how much they already knew were the ones least likely to succeed. The ones that observed and asked questions performed the best in the long run. An important lesson to learn.

Beginner traders often feel like they need to have all the answers. I know I did.

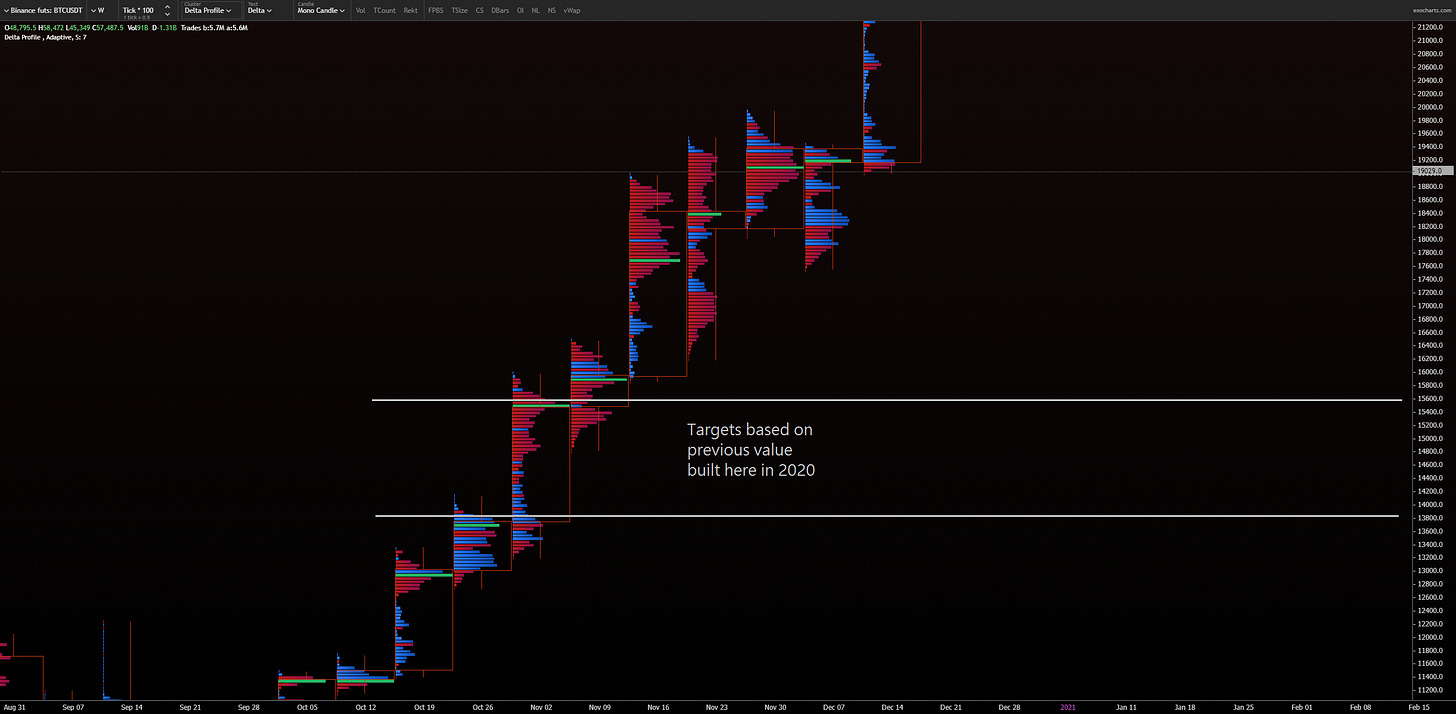

In his piece, @jimtalbot looks at high-timeframe BTC price levels and sets his targets and invalidations.

In his first-ever piece for Alpha Mail, @coldbloodshill gives us an overview of the current state of the NFT market and highlights some possible catalysts for change.

Enjoy!

alpha

Interview: Glimmerycoin

Glimmery takes us through his experiences trading at a prop firm, profiting over 60 BTC in under one minute and the number one trait he sees in successful traders.

Jim Talbot: Higher Timeframe BTC Outlook

I think people are underestimating the structure currently and clinging to it still being range bound (which technically it is) but at some point it's worth contemplating range expansion when we have such structures as these.

A noteworthy rejection on the 21st looks like failure to me. If we look left at the value built up from buyers at the 19800 price point we can see that those buyers are now capping price.

Looking at the current price it's struggling to even reclaim the value built up on the 22nd at 19k.

I can't see much reason to not expect more downside based on the daily structure alone. Reclaiming 19,800 on a few closes would potentially invalidate this.

Weekly View

Weekly doesn't look much better. Trading below three consecutive overlapping POC’s at 19,750 and rejecting a retest of them. With a lot of buyers trapped above 21,100 and most of the week's buying done above this week's POC of 19,100.

It's a beautifully balanced weekly profile that likely leads to expansion next week. Based on the levels it's trading under, I think the probability is quite heavily skewed to the downside. 19750 reclaim again being the invalidation.

As far as targets go, if this breaks down from a three-month range. You have to expect a significant size move off it based on historical data.

The last multi-month range break resulted in a 50% move down. If this were to repeat that would amusingly take us right into multi-year value POC at 9,800 but that's not my prediction as of yet.

If this breaks down next week I believe we can see prices dip to within 13,800 and 15,500 depending on the illiquidity of the move. This is a high conviction prediction for me as long as prices remain capped at 19,700.

CBS: The Current State of the NFT Market

Volume drying up, liquidity conditions getting even worse, communities collapsing and bear market vibes are thoroughly entrenched in the world of NFTs.

The last six months have been tough on crypto as a whole, not just NFTs. In the past speculation was always on the effect of reducing base-currency prices for NFTs, reducing ETH/SOL costs would be a positive for the market.

We’ve seen that’s not been the case so far, a mix of retail disinterest, rising costs of living and the good times of the bull market slowly becoming a distant memory.

But it’s not all bad news for the NFT market.

Blue chip collections have been holding up well, despite the lack of volume floor prices have stabilized and the volatility of pricing is calming down. With cheaper ETH prices they’re also providing more accessible points of entry for those new to the space or priced out of entry previously.

SOL NFTs have picked up in volume with Magic Eden having a fantastic end of August/start of September and interest increasing substantially with the release of y00ts.

1/1 artists have also continued to see interest - perhaps as people explore other art as ETH price falls or as a more bullish case as more collectors move into the space.

Some recent sales from Fewocious and DeeKay:

Photography NFTs have also seen a continued increase in interest. As demonstrated by Tim:

I’ll summarize my key thoughts on the past few months and the way I see the market:

● PFPs are out of favour, the market is more demanding of a project and the free-flowing money has dried up.

● Blue chips continue to be blue chips.

● 1/1 sales are continuing to grow and increasing in interest.

● The market is looking for a catalyst, PFP projects feel stale and there’s been little to excite the market (except Art Gobblers which we’ll talk about next time)

● Crypto-wide conditions have impacted the NFT market - participation is down, less capital is floating around and declining prices make it less attractive to have to hold capital in a base crypto.

Some may consider these conditions an opportunity. Time will tell, but I remain unfalteringly bullish on the NFT space as a whole and I look forward to continuing to provide my commentary and thoughts.