Alpha Mail - #041 - Dentoshi

Trading is often portrayed as a lonely undertaking, long hours isolated in front of the screen. While that can obviously be true for some, it doesn't have the case for all.

This week's interviewee @Dentoshi, talks about how a sense of community within crypto gave her the impetus to get stuck into the markets as well as the individuals that helped her develop as a trader.

It goes to show that the amount of valuable information on trading and crypto that is available, for free, to those who know where to look is astounding.

On that note, Jim Talbot is back with his thoughts on Narrative and value perception following the Ethereum Merge.

Enjoy!

alpha

Interview: Dentoshi

Dentoshi shares the three milestones that shaped her trading, the importance of managing information overload and the benefits of learning to trade in a bear market.

Jim Talbot: Narrative and value perception

Narrative rationalises poor decision-making at bad prices.

Critical thinking is our best tool for analysing markets, hard data is truth.

The problem with tying price movement to a narrative is that it can skew your perception of what something's value really is and why it is moving. This is especially true if you are invested in that narrative personally.

Detachment is your best line of defence when making rational decisions on how to position in the market.

Weakness at resistance is weakness at resistance, and vice versa at support. More often than not, the narrative doesn't change this fact, unless underlying market conditions are favourable. It's important to take a broader look and ask yourself if anything has changed.

Let's take the ETH merge as an example.

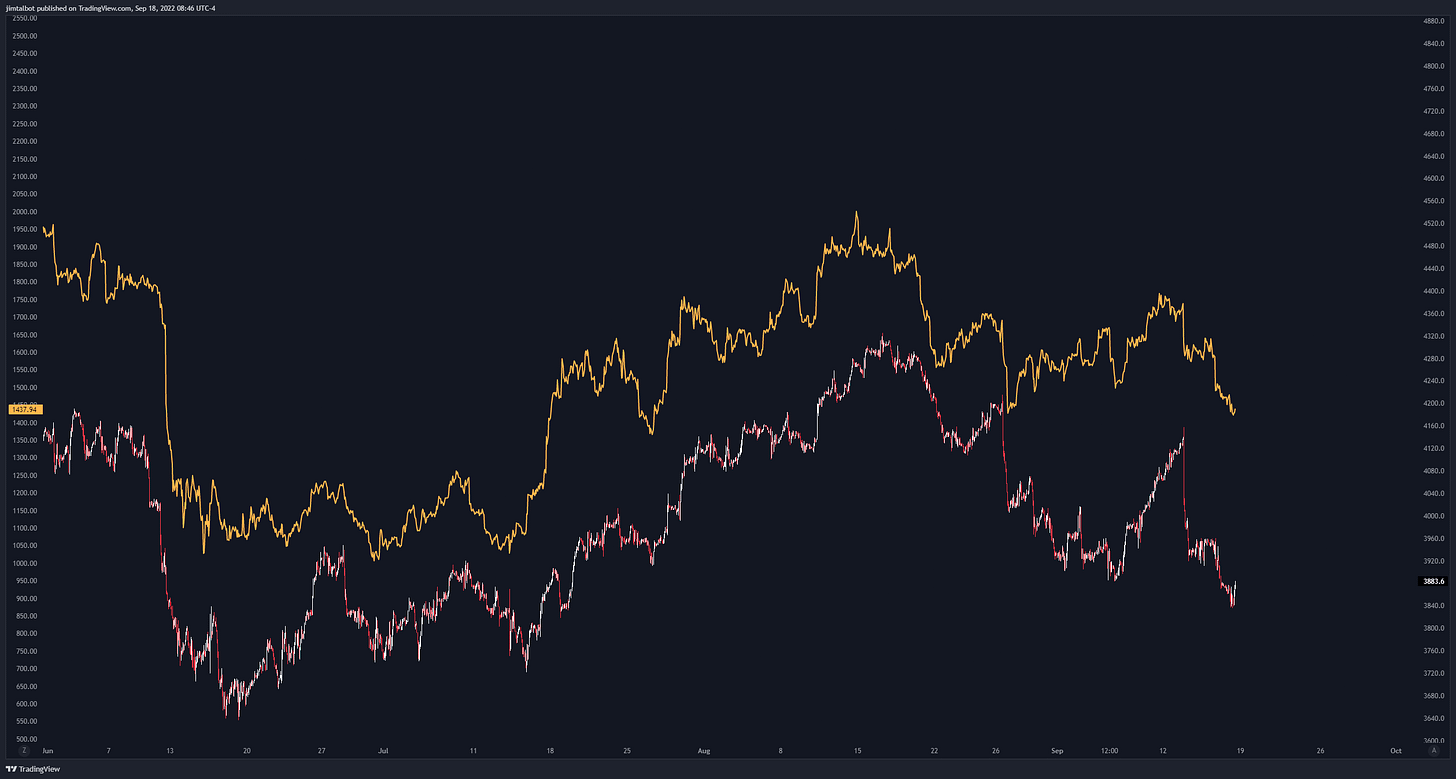

How much of ETH’s recent rally was just a continuation of its tight correlation to ES/NQ? If we look solely at how price has developed irrespective of narrative, what does it tell us?

The only thing the narrative did for ETH in my opinion is give us better prices to sell in a continuing bear market. In hindsight, I think $2,000 ETH was a gift and I think over the next few weeks and months we will gravitate back towards $1,000.

One of the things I think a lot about is how the market is auctioning going into a catalyst. Are people chasing? Is demand being tested? Are buyers exuberant? How much steam is left going into the event?

One of the faults of the market recently is the aggressive use of TWAP from a handful of participants trading size across Binance futures and FTX that cause excessive sustained periods of imbalance. These methods of execution never give the market chance to reset and test demand to pick up sidelined participants (of which there aren't many in current conditions). Once those passive consistent market orders switch off, the rebalancing of delta is often aggressive relative to the effort put in on the move up.

Ending Thoughts:

Whenever there is a strong narrative in a less than favourable environment it's good to have a plan to position accordingly, and not get swayed into thinking “this time is different.” If you caught the uptrend, well played but having a plan to exit initially without holding on to an emotional outcome is good practice for making money, which is what we should all be here to do.