Alpha Mail - #040 - RedXBT

As a minimalist, I often ask myself what can I remove? How can I make this simpler? A question, that this week's interviewee, @redxbt echos in his thoughts around edge and trading systems.

Red explains that it's easy to get caught up in the complexity, and argues that many traders would be better off keeping it small and simple. Spend less time theorising complexity, and instead keep it simple and get real, hands-on experience.

On the technical side, Jim Talbot examines open interest and key levels for Bitcoin this week, after last week's rally.

Enjoy!

alpha

Interview: RedXBT

Red shares his thoughts on theory vs experience, his struggle with emotional control and why traders would benefit from going after the simplest available edge.

Jim Talbot: Levels to Watch for the Week Ahead

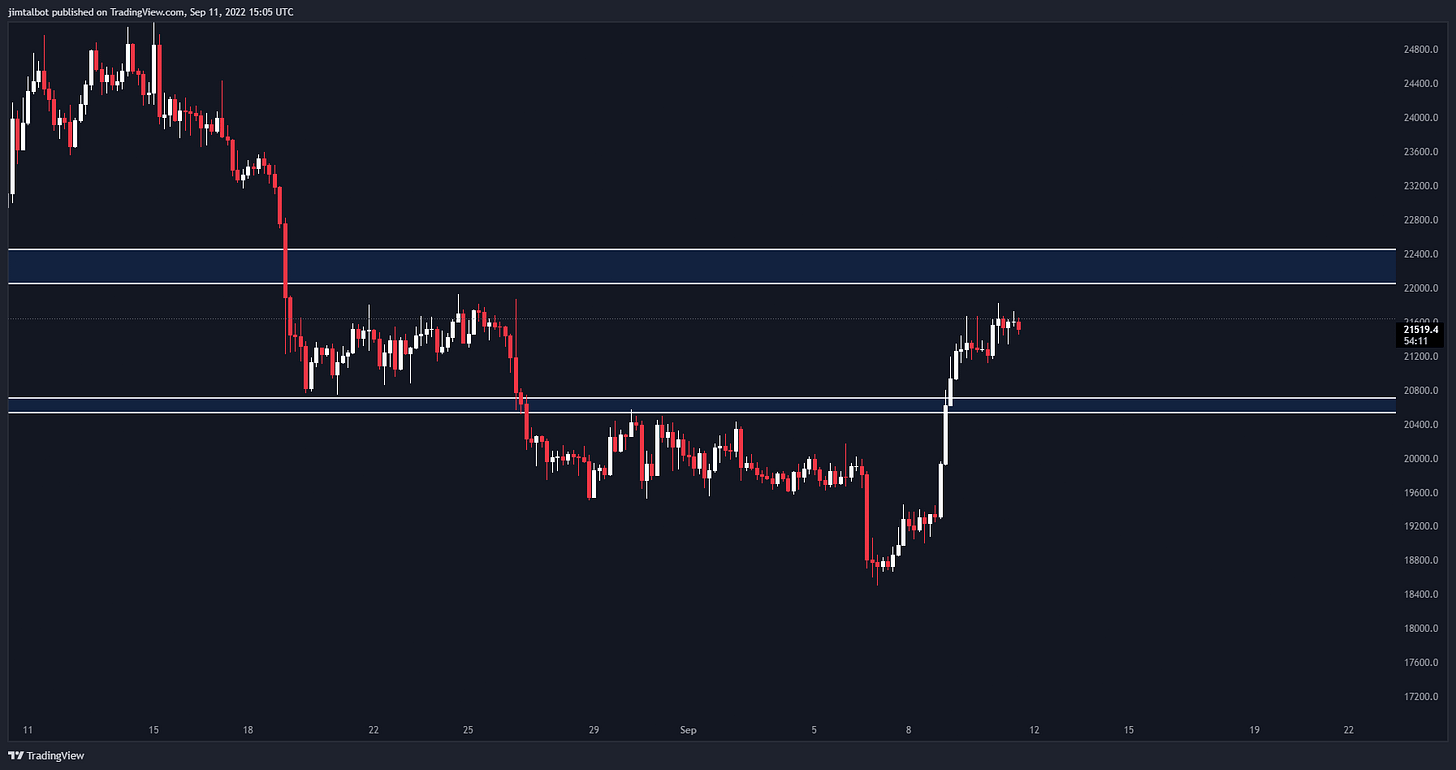

After a decent size move off the 18500 demand zone, let me share with you my thoughts going into next week.

After a relatively muted response initially off the 18,500 zone, Bitcoin rallied hard up to resistance around 21,500. In my opinion, the move came from an inability of sellers to break it down further. This caused a trap setup that gave fuel to a significant squeeze higher, rather than a true indication of strong demand from buyers.

The initial leg up was fuelled predominantly by heavy short interest into the lows, followed by new long positioning and further short covering in a range between 20600 and 21800.

The significant delta imbalance on stable margin relative to spot activity is cause for concern for anyone long between those two levels cited above. The increase in delta compared to the increase in open interest also indicates how much volume was shorts closing compared to fresh buyers.

Going forward then, focussing on lower time frames first, there are juicy stop losses above (22,050/22,450) and below (20,910/20,540). These are the levels I will be focussing on early in the week for potential day trade setups.

As far as the higher time frame goes, not much has changed contrary to the general sentiment shift seen on CT. There are definitely already some signs of waning momentum on this move that make me see the potential of this just being another trap in a longer-term chop range.

My main levels remain the same and I will use my lower time frame levels as pivots for how to play the larger range as follows:

Graphic: #166

"None of us got here without paying our tuition to the market; it’s the best and only way to learn" @Husslin_